Boost Your Company's Cash Flow with Accounts Receivable Outsourcing Services

Outsource AR Services: Optimize Your Financial Workflow

Making strategic decisions is necessary to keep ahead in the always-changing world of corporate operations, particularly in crucial areas like finance. Accounts receivable outsourcing services calculated action boosts a company’s overall efficiency and profitability while also simplifying financial procedures.

Outsource accounts receivable Services for all industries: Retail, Manufacturing, Restaurant, Electrical Contractors, Startups, Small Businesses, Travel, Dental Practice, Healthcare, Information Technology, Real Estate, Energy and Utilities, Transportation Industry, Nonprofit Organizations, Education, Construction, Law Firms, E-commerce ETC.

Your Trusted AR Outsourcing Partner

Why Should You Outsource Accounts Receivable?

There is no right option when it comes to outsourcing your accounts receivable because there are a lot of factors to consider. Before making a decision, any business must carefully examine both its internal and exterior activities. Accounts receivable outsourcing has several benefits which are listed below. Let’s have a look-

Expertise: When you outsource to specialist companies, you are putting your accounts receivable in the hands of professionals with great expertise and training in effectively managing collections.

Cost-effectiveness: Payroll, benefits, training, and infrastructure expenditures can make running an internal accounts receivable department costly. Outsourcing is frequently more affordable since you just pay for the services you utilize.

Decreased risk: Reputable outsourcing companies usually have strong systems developed to guarantee accuracy, thus outsourcing helps reduce the risk of mistakes in invoicing, collection, and compliance with regulations.

Better cash flow: Processing and collecting invoices more quickly is one benefit of outsourcing, which also helps with working capital management.

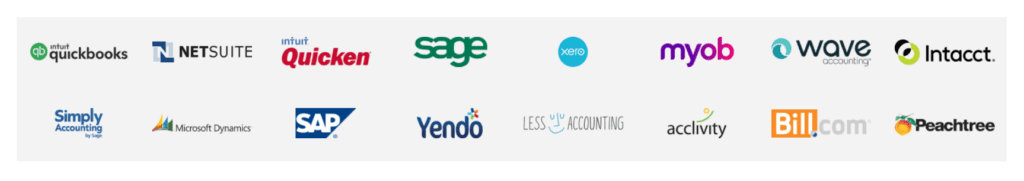

Technology accessibility: For effective billing, invoicing, and collection procedures, outsourcing companies frequently use cutting-edge software and technology, which may not be cost-effective for smaller enterprises to use on their own.

Benefits of Accounts Receivable Outsourcing Services?

1. Cost Efficiency: Outsourcing accounts receivable services can significantly reduce operational costs.

2. Improved Focus on Core Competencies: Entrusting accounts receivable tasks to external experts allows businesses to redirect their focus on core competencies.

3. Access to Specialized Talent: Outsourcing firms often employ skilled professionals with expertise in accounts receivable management.

4. Scalability and Flexibility: One of the notable advantages of outsourcing accounts receivable services is the scalability it offers.

5. Timely and Accurate Processing: Dedicated accounts receivable professionals in outsourcing firms are equipped to manage tasks efficiently and adhere to timelines.

Get a Free Quote!

Our Tailored AR Solutions for Diverse Industries

- AR Services for Retail Industry

- AR Services for Manufacturing Industry

- AR Services for Restaurant Industry

- AR Services for Electrical Contractors

- AR Services for Startups

- AR Services for Small Businesses

- AR Services for Travel Industry

- AR Services for Dental Practices

- AR Services for Healthcare Industry

- AR Services for Information Technology

- AR Services for Real Estate

- AR Services for Energy and Utilities

- AR Services for Transportation Industry

- AR Services for Nonprofit Organizations

- AR Services for Education Industry

- AR Services for Construction Industry

- AR Services for Law Firms

- AR Services for E-commerce Industry

Our Accounts Receivable Outsourcing Services

Maintaining a Record of The Bills

Regular Billing and Delivery to Customers

Creation of Invoice

Record of Received Payments

Adjusting the Payments with Invoices

Linking Payment Gateways and the Accounting Software

Regular Follow-Ups with Debtors for Pending Invoices

Discounting the Debtors

In-Depth Analysis of Accounts Receivable Reports

We Support Multiple Accounting Software

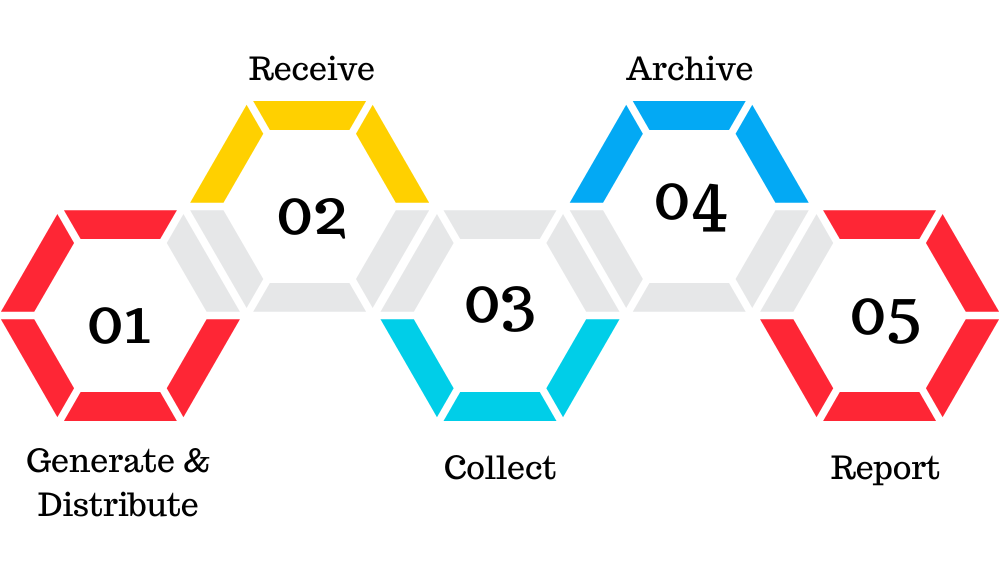

Our Accounts Receivable Process

Service Level Agreements (SLA)

Days Sales Outstanding (DSO)

% of AR Balances within Terms

Cash application Cycle Time

% of Cash Application Accuracy

Released Orders From Hold

Unapplied Cash Balance Per Account

Our Client's Testimonials

Arthur

Outsource AR has become an integral part of our financial strategy. Their commitment to accuracy, coupled with a client-centric approach, has made them our go-to partner for accounts receivables services.

George

Reliability and results: that’s what Outsource AR brings to the table. Their comprehensive receivables services have added immense value to our business, and we couldn’t be more satisfied with the outcomes.

Noah

Outsource AR’s team goes beyond expectations to ensure our accounts receivables are handled with precision. Their proactive approach has significantly reduced outstanding payments & improved our cash flow.

Archie

Outsource AR’s professionalism and commitment to delivering timely receivables services have made them an invaluable partner for our business. Their expertise has undoubtedly contributed to our financial success.

William

The team at Outsource AR understands the dynamics of our industry. Their custom-tailored approach to accounts receivables aligns perfectly with our needs, resulting in improved financial efficiency & cash flow.

Charles

Efficiency at its best! Outsource AR’s dedicated team ensured our accounts receivables were managed seamlessly. Their expertise and attention to detail have been instrumental in optimizing our financial processes.

Outsource AR is The Most Trusted Accounts Receivable Outsourcing Company

Outsource AR clientele spans various industry sectors across the world earning us a reputation as a leading global provider of outsourced accounts receivable services.

As experienced specialists in accounts receivable management, we have enabled our clients to optimize their working capital by significantly reducing their day sales outstanding and enhancing their collection effectiveness index. We provide you an enhanced accounts receivable process that facilitates strategic collections.

Outsource AR team follows standard accounts receivable procedures, including establishing credit rules, drafting terms and conditions documents, issuing regular invoices, generating comprehensive accounts receivable reports to gauge liquidity, and devising effective collection strategies.

With Outsource AR expertise and commitment, we strive to elevate your accounts receivable operations and drive tangible results for your business.

OUR TEAM

Divyansh Singh, CFO

Meet Divyansh, an accomplished CFO with an MBA degree, boasting over a decade of experience in serving public and private companies across diverse industries, including SaaS, healthcare, and manufacturing. His unique blend of financial, operational, and managerial expertise positions Divyansh as an adept strategist, excelling in high-level, forward-thinking financial initiatives. Proficient in data modeling, financial forecasting, cash management, budgeting, reporting, debt and equity financing, and financial analysis, Divyansh stands out as a seasoned professional in the financial landscape. Beyond his strategic finance acumen, Divyansh possesses significant systems experience. He has successfully overseen ERP/billing systems implementations and optimizations, demonstrating proficiency in managing the adoption and application of new technology, network infrastructure, and financial systems.

Shiv Kumar, CFO

An MBA graduate, Shiv brings over 12 years of executive finance experience, showcasing a proven track record in forecasting, budgeting, operational optimization, and strategy development and implementation. Shiv's expertise lies in strategic growth, process improvement, financial controls, and asset protection. His skill set encompasses multi-million LOC management, cash flow forecasting, budgeting, KPI tracking, fixed asset management, and financial analysis. Shiv has demonstrated his leadership prowess by assembling and leading successful financial teams. His direct collaboration with business leadership has consistently optimized company performance, profitability, and forecasting. This includes conducting due diligence in acquisitions, overseeing audits, financial modeling and forecasting, developing banking relationships, and enhancing reporting and processes.

Sanskar Sharma, Senior Manager

Sanskar is a seasoned CA with extensive experience in financial reporting and management. Known for his exceptional planning and organizational skills, Sanskar has overseen numerous financial projects from initiation to completion. With a proven ability to handle multiple assignments under pressure and meet tight deadlines, he has made significant contributions in diverse industries. Sanskar excels in ensuring compliance with government regulations and guidelines and has played a crucial role in optimizing processes for efficiency and cost savings. With a track record of successfully managing contracts throughout their lifecycles, Sanskar brings valuable expertise in developing and implementing highly effective finance-related solutions.

Raj Bala, Senior Manager

With nearly a decade of experience in the accounting industry, Raj is known for her seamless connection with clients, marked by professionalism and timely responsiveness. Backed by an MBA degree, she has significantly impacted organizations across various industries by enhancing efficiencies and reducing costs. Raj brings a unique blend of consulting and real-world industry experience to the table, leveraging adept skills in sales, strategic planning, and channel management. Her thoughtful discussion and creative problem-solving abilities make her an invaluable asset, showcasing deep expertise and understanding of the finance industry. Raj's commitment to delivering exceptional results and her dedication to client satisfaction have consistently earned her recognition as a trusted advisor.

Accounts Receivable Outsourcing Blogs

Our Key Differentiators

→Data Security

→High-Quality Services

→Highly Experienced Team

→Customized Pricing Plans

→Dedicated Supervisor

→Improved Customer Service

→24*7 Support

Outsource Accounts Receivable Services to Us

Accounts Receivable Outsourcing FAQs

1. What is Accounts Receivable Services?

The practice of assigning an outside service provider to handle an organization’s accounts receivable function is known as outsourcing AR (Accounts receivable). Sending invoices and statements, getting payments, following up, reporting on AR performance, account reconciliation, and many other things can fall under this category.

2. How can outsourcing AR benefit my business?

Outsourcing accounts receivable can provide many benefits, including freeing up internal resources, boost cash flow, decrease bad debt, and boost efficiency and accuracy. Outsourcing providers often have specialized expertise and technology that can help streamline processes and improve results.

3. What types of businesses can benefit from outsourcing accounts receivable?

Any business that processes a high volume of invoices and receives payments from customers can benefit from accounts receivable outsourcing. This includes businesses of all sizes and across industries, from small startups to large corporations.

4. What should I look for in an AR outsourcing provider?

When choosing an outsourcing provider, it’s important to consider factors such as their experience and expertise, the quality of their technology and processes, their track record of success

5. How does outsource accounts receivable services integrate with my existing accounting processes and systems?

Our approach involves establishing a secure data exchange, offering comprehensive training and support for your team, and collaborating closely to ensure perfect alignment of all processes. We understand the importance of a smooth transition, and our dedicated professionals are committed to facilitating a seamless integration that enhances your overall financial workflow.